Bitcoin Price: Retail Investor 'Max Desperation' Signals What?

Alright, so Bitcoin's playing its usual game of "how low can you go?" Below $100K? Again? Give me a break. We're supposed to freak out because it's at a "five-month low"? Zoom out, people. Seriously. Five months in crypto is like five years in the real world. It ain't even a blip.

The "Desperation" Narrative

This whole "retail investor in max desperation" line that Bitwise CIO Matt Hougan is peddling... I'm calling BS. Or at least, I'm saying it's only half the story. Sure, some newbie who yolo'd their savings into Dogecoin probably sweating bullets right now, but let's be real, those guys are always sweating bullets. That's kind of their thing.

Hougan says the "crypto native retail is just more depressed than I've ever seen it." Maybe. Or maybe they're just tired of being rug-pulled and exit scammed every other week. You know, burnt once, shame on them, burnt twelve times... maybe they finally learned a lesson?

And this idea that institutions are somehow immune to the crypto winter? Please. They're just better at hiding their panic. They've got fancy algorithms and HFT setups to make it look like they know what they're doing, even when they're furiously dumping their bags.

Rate Cuts and Risky Bets

The article mentions the Fed's interest rate shenanigans. Lower rates good for crypto, higher rates bad. We've seen this movie before. It's like the world's most boring rom-com. Except instead of two quirky people falling in love, it's lines on a graph doing the tango.

And Lisa Cook "undecided" on a rate cut? Offcourse she is. They're all "undecided." It's their default setting. It's like asking a politician if they're going to raise taxes.

The real question is, who's actually buying this dip? Are we talking about legit institutional investors, or are we talking about Trump Media and Technology Group throwing another $2.5 billion into their "corporate bitcoin reserve"? Because if it's the latter, I'm even more bearish than I was five minutes ago. That sounds like a prelude to some kind of SEC investigation.

The Whale Games Begin?

So, if retail's supposedly in "max desperation" and the institutions are playing coy, who's left? The whales, baby. The guys who've been waiting for this exact moment to scoop up Bitcoin on the cheap. The guys who probably caused this dip in the first place.

It's the circle of crypto life. Price goes up, plebs fomo in, whales dump, price crashes, plebs panic sell, whales buy back in, price goes up again. Repeat ad nauseam.

Treasury Secretary Scott Bessent bragging about the US government's $15-20 billion bitcoin stash? Is that supposed to make us feel secure? It just makes me wonder who got the sweetheart deal on that purchase. Probably some buddy of a buddy of a politician...

So, What's the Real Story?

Look, I'm not saying Bitcoin is going to zero. Probably. But this whole narrative of "retail desperation = buying opportunity" is just another way for the whales to pump their bags. Don't fall for it. Or do. I don't really care. I'm just a guy with a keyboard and a crippling caffeine addiction. Then again, maybe I'm the crazy one here.

We're All Just Pawns in the Game

Related Articles

Polymarket: Shayne Coplan's Billion-Dollar Bet and What It Means for the Future of Prediction Markets

Polymarket's $8 Billion Valuation: More Than Just a Bet Okay, folks, buckle up, because we're about...

Pudgy Penguins: The Price Hype and What We Actually Know

So, everyone’s losing their minds over whether the Pudgy Penguins crypto token, PENGU, can "defend"...

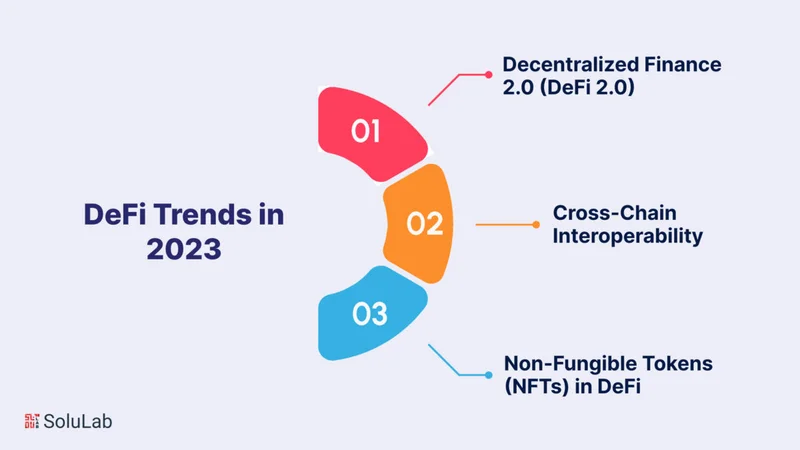

Beyond the Hype: The Real 2025 DeFi Performance

Solana's 2025: Beyond the Hype, Into the Numbers Solana. It promised high throughput, low fees,...

Zcash vs. Monero: Privacy Coin Power Shift and Roadmap – What We Know

Zcash's Privacy Play: Hype or Real Revolution? Electric Coin Co. (ECC), the brains behind Zcash (ZEC...

Monero's Privacy Revival: What's Driving the Price Surge and Reddit's Obsession

Crypto's "Privacy Revival"? More Like History Repeating Itself (Badly) So, crypto's gone "full circl...

Zcash Surging: Cypherpunk Principles vs. Market Reality

Zcash's "Encrypted Bitcoin" Narrative: More Hype Than Hashrate? Zcash is making noise, pitched as th...