The Nasdaq's Unstoppable Climb: What's Really Driving It and What It Means for Our Future

Last week, on November 10th, 2025, the stock market did something remarkable. On the news of a Senate breakthrough to end the government shutdown, the Dow Jones didn't just climb; it leaped. It roared back to life with the kind of sudden, explosive energy that makes cable news anchors sit up straight. Most analysts saw it for what it was: a simple sigh of relief from Wall Street. Capital, they said, abhors uncertainty.

They’re not wrong, but they’re missing the real story.

What we witnessed wasn't just a financial event. It was a biological one. It was the frantic, gasping breath of a complex organism that had been momentarily starved of oxygen. To see this as just numbers on a screen is to miss the profound truth it reveals about the deeply interconnected, technologically-fused world we now inhabit. This wasn't a market correction; it was a system-wide immune response. And it’s a signpost pointing directly toward our future.

The System’s Ghost in the Machine

Let’s reframe this. For weeks, a bug in our political operating system—a piece of legacy code from a bygone era—caused a critical failure. The government shutdown was, in technological terms, a denial-of-service attack on the nation itself. It wasn't an external threat; it was a self-inflicted wound, a deadlock in the central processor that threatened to cascade through the entire network.

And then, the breakthrough. The bug was patched. What happened next? The market’s surge—a Stock market jumps on reports of Senate breakthrough to end shutdown (DJI:)—was the network re-establishing its connections, purging the error, and flooding the system with the lifeblood it needs: confidence. When I saw the Dow leap like that, my first thought wasn't about portfolios. I honestly felt a wave of relief, because it was a sign that for all our divisions, the underlying human desire for progress and stability is an incredibly powerful, almost gravitational force.

Think of it like this: our economy is no longer a simple machine with levers and pulleys. It’s a neural network. It’s a sprawling, decentralized, and semi-sentient web of transactions, supply chains, and information flows. The market indices, like the Dow and the S&P 500, are the EEG readouts of our collective consciousness. They measure our fear, our ambition, our belief in tomorrow. The shutdown was a system anomaly, and the market’s violent reaction was the system’s ghost in the machine screaming, “I want to live! I want to function!”

What does it say about us that our collective financial instrument reacted with more speed, clarity, and unity of purpose than our own elected leaders?

Our Analog Laws in a Digital World

This event throws a harsh spotlight on a fundamental tension of the 21st century. We are running a digital, globally-networked society on an analog political chassis. This is a classic case of asynchronous development—in simpler terms, our technological and social evolution has massively outpaced our political structures, and the friction is starting to throw sparks.

Our world operates on fiber-optic speeds, with capital and ideas crossing borders in microseconds. Yet, our governance plods along at the speed of paper, held hostage by procedural rules that were designed for an agrarian republic. This isn't just about Democrats and Republicans anymore, it's about a 21st-century global network being throttled by a 19th-century political rulebook and the tension is becoming unbearable, you can feel it in the market's wild swings and the public's deepening exhaustion.

This isn’t a criticism; it’s an observation of a system under stress. It’s the same dynamic we saw with the music industry before Spotify or the taxi industry before Uber. An old, centralized model was straining to contain a new, decentralized reality. The difference is, when the political model strains, it doesn't just disrupt a single industry; it threatens the entire platform on which we all operate.

The real question this shutdown forces us to ask is a deeply ethical one. What is our responsibility, as creators and citizens, to design more resilient, responsive, and adaptive systems of governance? Are we content to just keep applying software patches to a failing motherboard? Or do we have the courage to start imagining a new architecture—one built for the world we actually live in, not the one we left behind a century ago?

The Signal Through the Noise

So, what’s the real takeaway from the market’s roar on November 10th? It’s profoundly optimistic. The story isn't that our political system is fragile and can grind to a halt. The story is that the vast, interconnected network of human endeavor is so powerful, so resilient, that its demand for progress can drown out the noise of political gridlock.

The shutdown was a temporary glitch. The recovery was the signal. It was a powerful reminder that the fundamental human drives—to build, to connect, to trade, to create a better tomorrow—are far more enduring than the temporary squabbles that seek to divide us. The market, in its own chaotic way, was voting for the future. It was a vote of no-confidence in paralysis and a resounding vote of confidence in connection. And in that signal, we can find all the hope we need.

Related Articles

The $5.2 Billion Bet on Akero Therapeutics: What This Means for the Future of Medicine

Here is the feature article for your online publication, written in the persona of Dr. Aris Thorne....

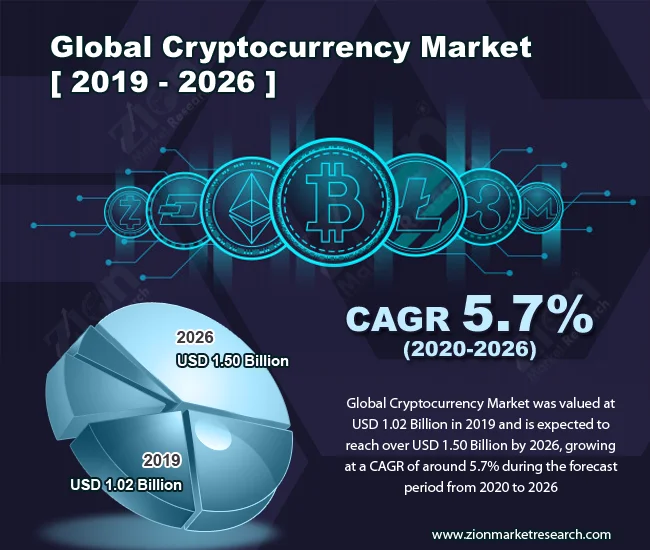

Crypto Market: The Fix Is In. (- Reactions Incoming!)

Crypto's "Stabilization Phase": Or Just a Temporary Stay of Execution? The Siren Song of...

US Government Backs Trilogy Metals (TMQ): Why It's Soaring and What It Signals for America's Future

I just read a press release that, on the surface, is about a mining company in Alaska. And I can’t s...

Rigetti Computing (RGTI) Secures $5.7M Quantum Order: Dissecting the Bull Case After its 9.6% Jump

Decoding Rigetti's Quantum Leap: Is a $5.7M Sale Worth a 25% Stock Pop? The news, when it hit the wi...

Nebius Stock Powers Up: What's Driving the Optimism?

Nebius: More Than Just a Stock Surge – It's a Glimpse Into Tomorrow Okay, folks, buckle up, because...

Robinhood's Next Chapter: Decoding the 2025 Vision and What It Means for the Future of Investing

It’s easy to get lost in the numbers, and with Robinhood in 2025, the numbers are absolutely stagger...