Dow Jones Rollercoaster: Up, Down, and Who Even Cares?

Generated Title: Tech's "Normal Pullback" is Just Another Way of Saying "We Lied to You"

Okay, so the market had a rough week. Big deal. We're supposed to believe this is just a "normal pullback" after tech stocks went on some kind of joyride since April? Give me a break. It's like your ex saying, "It's not you, it's me" right before they ghost you.

The Magnificent Seven's Miserable Week

The Dow and S&P squeaked out a win on Friday, but the Nasdaq? Still bleeding. And those "Magnificent Seven" stocks? More like the "Pathetic Seven" this week. The tech sector is dragging everything down while the rest of the market is, supposedly, doing okay. So, what, tech is not part of the economy now? That's the story we're going with?

David Donabedian from CIBC Private Wealth (never heard of 'em, but okay) is telling Barron's this is just a "short-term trend reversal." Right. Because these guys are always right, offcourse. It's always "short-term" until it's not. And then it's, "Nobody could have predicted this!" According to Stock Market News From Nov. 7, 2025: Dow, S&P 500 Rise; Nasdaq Falls; Tesla, Nvidia, Expedia, More Movers the Dow and S&P 500 did manage gains that day, while the Nasdaq fell.

He says he's "cautiously bullish." What does that even MEAN? You're either bullish or you're not. This wishy-washy crap is why people hate Wall Street. It's all about covering their asses, not giving real advice.

Bond Market BS

And then there's the high-yield bond market, which Donabedian says "looks OK." "Looks OK"? That's the best you got? Are we basing our entire financial future on vibes now? Last time I checked, "looks OK" is what people say about a suspicious-looking gas station sushi.

Speaking of bonds, the 2-year Treasury note is down to 3.56%. The 10-year? 4.09%. Numbers, numbers, numbers. What do they even mean to the average person struggling to pay rent and afford groceries? Probably nothing. It's all just noise designed to make us feel like we're too stupid to understand what's going on.

It all feels like a giant game, and we're the pawns. They pump up the tech stocks, everyone jumps in, then they pull the rug out, and we're left holding the bag. Rinse and repeat.

The Real Question

The real question is, who benefits from all this volatility? It ain't the little guy. It's the hedge funds, the big banks, and the insiders who get to buy low after they engineered the dip.

Honestly, I'm starting to think the whole system is rigged. They want us to believe in the "long-term" and "stay the course," but what if the course is just a slow, steady decline designed to enrich the already rich?

Then again, maybe I'm the crazy one here. Maybe I'm just too cynical. Nah, who am I kidding?

So, What's the Real Story?

It's the same old song and dance: Tech overpromises, underdelivers, and then blames the "market" when things go south. Ain't buying it.

Related Articles

That VTI 'What If' Article: Why It's Mostly Garbage

So, I pulled up my portfolio this morning. September 4, 2025. Ten years to the day since I dropped a...

The $5.2 Billion Bet on Akero Therapeutics: What This Means for the Future of Medicine

Here is the feature article for your online publication, written in the persona of Dr. Aris Thorne....

Dan Schulman Named New Verizon CEO: What His PayPal Past Means for Verizon's Future

Verizon’s New CEO Isn’t About 5G. It’s About a Quiet Panic. The market’s reaction to the news was, i...

Robinhood's Next Chapter: Decoding the 2025 Vision and What It Means for the Future of Investing

It’s easy to get lost in the numbers, and with Robinhood in 2025, the numbers are absolutely stagger...

The QQQ Hype Train: What the big money is doing and why you should probably ignore it

So a mid-sized wealth management firm you’ve never heard of just plopped down nearly $5 million on a...

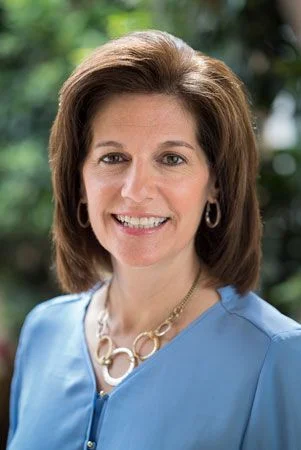

Cortez Masto's Shutdown Vote: What Happened and Why?

The Shutdown Show: Cortez Masto's Calculated Game Nevada Senator Catherine Cortez Masto has cast 14...