Malta: What's with Poland, and what's the real story?

Sky Bet's Malta 'Shift': Don't Call It Efficiency, Call It What It Is

Alright, folks, buckle up. I’ve been staring at these corporate press releases, and lemme tell ya, the stench of B.S. is thick enough to cut with a knife. Sky Bet, or more accurately, its behemoth parent company Flutter Entertainment, just packed up its sports betting operations and shipped 'em off to Malta. Flutter relocates SkyBet's HQ to Malta in bid to save millions in taxes. Why? Oh, you know, "to operate more efficiently and reduce costs." Give me a break. We're talking about saving up to £55 million annually in taxes. Fifty-five million pounds. That ain't efficiency; that's a tropical tax dodge, pure and simple.

You wanna talk efficiency? How about the 250 UK employees who are now out of a job because of this "administrative shift"? Yeah, that's real efficient for them, isn't it? Flutter, a company valued at something like £30 billion, moving its primary stock listing to New York while keeping a secondary one in London, then pulling this stunt. It's like watching a magician's trick, except instead of a rabbit, they're pulling millions of pounds out of the UK economy and making it disappear into the Maltese sun. And offcourse, they expect us to clap.

The Shell Game Continues

This isn't some groundbreaking revelation, by the way. Tax specialist Dan Neidle put it bluntly: people go to Malta for "sunbathing or to avoid tax." I mean, come on, does anyone, anywhere, actually believe there's a third option? Sky Bet's regulatory ties to Malta go all the way back to 2017. They've been eyeing this move like a shark circling a slow-moving boat. They applied for a license back then, and then-Prime Minister Joseph Muscat was practically doing cartwheels about a "household name" relocating. It was always about the money, always about the loopholes.

And what about the supposed "risks" Neidle talks about? "Reckless," he called it. "Stuck in Malta" if the law changes. Sounds like a corporate gamble, right? The irony, it’s almost poetic. A massive gambling company making a risky bet on international tax laws. But here's the kicker: even if it goes belly-up, they've already pocketed millions, and those 250 UK jobs are still gone. Who really pays the price for this "recklessness"? Hint: it ain't the C-suite execs sipping cocktails in Valletta. It's the public finances, straining under the weight of these corporate maneuvers, while Flutter calls itself "the world’s largest sports betting and iGaming operator." That's a lot of words for "we're really good at making money disappear from the taxman's ledger."

Distractions and Disappearing Acts

It’s almost comical, isn't it? While the big boys are moving their entire operations to Malta to save a fortune, you've got the actual country of Malta playing a World Cup qualifier against Poland. Poland, by the way, needed an "absolute miracle" to take the top spot in their group, even after a 1-1 draw against the group leaders. They'll probably beat Malta—the prediction is 2-0—but it won't be enough. Malta vs. Poland: World Cup qualifying betting odds, prediction, pick. They're likely headed for the playoffs. It’s a game with stakes, sure, but it feels so… trivial, doesn't it? A quick, almost forgettable match on an island that's become a playground for corporate tax strategists.

Malta itself, a beautiful island in Europe, has only picked up five points in seven group matches, barely eking out a win against Finland. Their home record? One single point from a draw with Lithuania. So while the Polish football team is trying to claw its way into the World Cup against a team that’s, frankly, not exactly tearing up the pitch, the real game, the one with billions at stake, is happening behind closed doors. It's the game of shell companies, corporate structures, and finding that perfect sweet spot where you can rake in profits without contributing your fair share. Does anyone honestly believe these moves are about anything other than maximizing shareholder value at the expense of national treasuries? I certainly don't. Then again, maybe I'm just old-fashioned, expecting corporations to, you know, operate within the spirit of the law, not just the letter.

It's Always About the Money, Stupid

Related Articles

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

Avelo Airlines: Routes, Rivals, and the Unvarnished Data

Avelo's Expansion: A Smooth Flight or Turbulent Skies Ahead? Avelo Airlines is making headlines agai...

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...

The QQQ Hype Train: What the big money is doing and why you should probably ignore it

So a mid-sized wealth management firm you’ve never heard of just plopped down nearly $5 million on a...

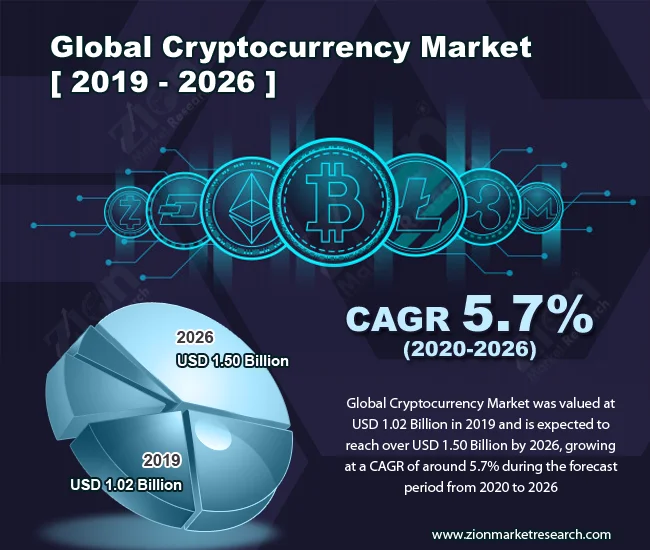

Crypto Market: The Fix Is In. (- Reactions Incoming!)

Crypto's "Stabilization Phase": Or Just a Temporary Stay of Execution? The Siren Song of...